Amid the complex web of international trade, proving the authenticity of a product can be near-impossible. But one company is taking the search to the atomic level

Last modified on Thu 16 Sep 2021 20.39 BST

Five years ago, the textile giant Welspun found itself mired in a scandal that hinged on a single word: “Egyptian”. At the time, Welspun was manufacturing more than 45m metres of cotton sheets every year – enough to tie a ribbon around the Earth and still have fabric left over for a giant bow. It supplied acres of bed linen to the likes of Walmart and Target, and among the most expensive were those advertised as “100% Egyptian cotton”. For decades, cotton from Egypt has claimed a reputation for being the world’s finest, its fibres so long and silky that it can be spun into soft, luxurious cloth. In Welpsun’s label, the word “Egyptian” was a boast and a promise.

But the label couldn’t always be trusted, it turned out. In 2016, Target carried out an internal investigation that led to a startling discovery: roughly 750,000 of its Welspun “Egyptian cotton” sheets and pillowcases were made with an inferior kind of cotton that didn’t come from Egypt at all. After Target offered its customers refunds and ended its relationship with Welspun, the effects rippled through the industry. Other retailers, checking their bed linen, also found Welspun sheets falsely claiming to be Egyptian cotton. Walmart, which was sued by shoppers who had bought Welspun’s “Egyptian cotton” products, refused to stock Welspun sheets any more. A week after Target made its discoveries public, Welspun had lost more than $700m from its market value. It was cataclysmic for the company.

Blindsided, Welspun struggled to understand what had gone wrong, but working that out wasn’t easy. The cotton business is labyrinthine, and the supply chains of products – running from the source farm to the shop shelf – have grown increasingly complex. A T-shirt sold in New Delhi might be made of cotton grown in India, blended with other cotton from Australia, spun into yarn in Vietnam, woven into cloth in Turkey, sown and cut in Portugal, bought by a Norwegian company and shipped back to India – and that’s a relatively simple supply chain. For years, Welspun had been buying raw cotton, yarn and whole cloth, all claiming to be of Egyptian origin, from dozens of vendors. The source of the fiasco might have been a mistake – a mislabelled shipment of cotton yarn, perhaps – or it might have been deliberate fraud by some remote supplier. Either way, it was lost in the maze.

In the thick of its crisis, Welspun sought out a company named Oritain. Founded in 2008, in the town of Dunedin in New Zealand, Oritain is a kind of forensic detective agency – a supply-chain CSI. Its work, which takes us into the heart of modern commerce, depends upon a basic truth about our planet. The Earth is so geologically diverse that, in a location’s soil or water, the precise concentrations of elements often turns out to be unique to that region. That singular mix of elements works its way into the crops from the region as well, so that cotton grown in the south of the US has a different combination of elements compared to cotton from Egypt – each combination distinct, like a signature.

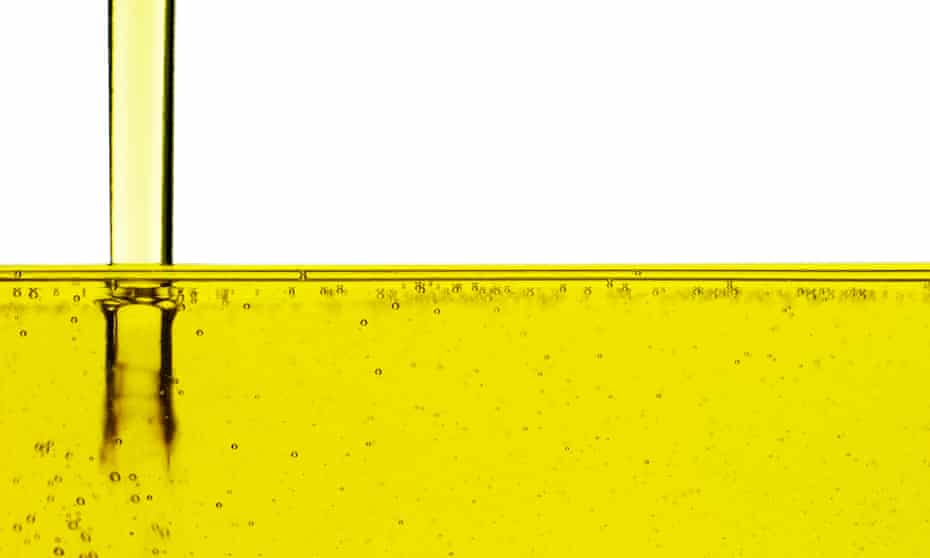

Prof Russell Frew, the geochemist who co-founded Oritain, had been studying element analysis at the University of Otago when he recognised how his research could address a major commercial problem. Fraudulent products sit on shop shelves everywhere. When they’re detected, they trigger fierce controversies, like the time in 2013, when British and Irish authorities found horse meat liberally mixed into “beef” patties. But for every headline-grabbing deception, there are countless unnoticed ones. Sugar syrup is blended into organic honey. “New Zealand lamb chops” come from Chinese feedlot animals; extra virgin olive oil is cut with cheap, inferior oil; T-shirts are stitched out of cotton grown on forced-labour farms. Labels often lie. The counterfeit food game alone is worth $49bn a year.

These deceits, Frew realised, could be sniffed out by element analysis: hence Oritain. The company’s clients include well known brands such as Primark, but also industry bodies such as Cotton USA and Meat Promotion Wales. All of them are keen to avoid nasty surprises of the kind that Welspun experienced, the kind that can burn up the bottom line or sink a range of products – the low-quality supermarket steak masquerading as prime Welsh beef, say, or the pair of socks that turns out to be made with cotton from Xinjiang, in China, where factories are suspected of using captive labour.

Oritain promises to determine with 95% accuracy if a coffee bean or a cut of meat is really from the source advertised on its label. Some items are easier to analyse than others. “Tea is a good one – it’s very rich in the elements we measure,” Frew told me. “We can distinguish between two tea estates that just have a dirt road between them.” But really, he added, anything that was once grown or reared will hold signs of its origins, its chemical terroir. With enough data, it will reveal the truth about where it’s from – and the lies in the tale being told about it.

Even as a boy, Frew knew the commercial worth of an origin story. Now 54, he has the fulfilled air of a scientist who’s made it as an entrepreneur. He grew up on a sheep farm in southern New Zealand owned by his grandfather, and although the meat was useful, it was really the wool that made money. “Back then, New Zealand wool was incredibly valuable,” Frew said. “In 1953, it sold for a pound per pound.” But by the time Frew went to university in the 1980s, the industry had collapsed, in part because of the popularity of cheap, swiftly made synthetic fibres. It felt like a lesson: even a product as fine and scrupulously sourced as New Zealand wool could be left behind by the quickening pace of the global economy.

As a young researcher at the University of Otago, Frew studied how the distribution of elements varied across the world’s oceans. The instrument he most relied on was the mass spectrometer, a machine that occupied half a room and measured the levels of different elements in any sample he fed intoit. If Frew had, say, a beaker of water collected off the coast of Brazil, the spectrometer could record the specific mix of metals and salts that had washed off the land into that part of the ocean. And if he found that unique signature elsewhere, he could know that the water off Brazil had moved around the world in an ocean current. Once, when he tested some water recovered from a depth of 5,000 metres in the channel between Britain and Greenland, he found that it had started from the Weddell Sea off Antarctica.

Throughout the 90s, as Frew ran marine chemistry projects at his university, his instruments kept improving. He could buy not just new plasma spectrometers, which could test for 45 elements at once, he told me, but also better bottle-washing equipment. When I laughed, Frew said: “I’m not kidding. The new tech was basically a big bucket of ultra-pure acid, which stripped off all the trace element impurities on the glass.” From that time on, he no longer had to worry about his samples being contaminated.

In 2001, New Zealand’s ministry of fisheries contacted Frew. They’d nabbed a couple of fishing boats registered to South Korean companies, and although the crews had permits to fish off New Zealand’s east coast, the ministry suspected they’d been trawling in western waters instead. The boats’ holds were brimming with hake. Was there a way to tell where they’d been caught? “The west coast is ancient rock,” Frew told me, “and there’s a disparity in how much dust blown over from Australia settles on one coast versus the other.” As a result, the levels of lead in water and marine life vary slightly from west to east. To appraise the ratios of lead in the hake, Frew had to fly to Boston to use a lab’s instruments there. “Lead was the smoking gun,” he said. The boats had been fishing illegally in New Zealand’s western waters after all. “That turned out to be a NZ$5m prosecution.”

“The Korean fish case,” as Frew calls it, was the story he told to get funding – from his university to buy equipment for his lab, or from investors to set up his first company, Isotrace, or from more investors for Oritain, which he set up after Isotrace folded. Oritain pitched itself not as a lab with forensic tools, but as a guardian of brand integrity. If a company’s high-end coffee or single-origin chocolate were actually being made with sub-par beans, and if that ever came to light, the company’s reputation, and its bottom line, would be destroyed. In 1993, Domenico Ribatti, one of Italy’s largest olive oil producers, was sentenced to prison for cutting his extra-virgin with Turkish hazelnut oil and Argentinian sunflower-seed oil. A decade ago, Noka Chocolate went out of business not long after a blogger reported that Noka was buying another company’s chocolate, presenting it as “a tasting experience” sourced from Venezuela or Ivory Coast, and selling it for 10 times the price at Neiman Marcus. And in 2019, French police announced that they uncovered a scam in which 15,000 tonnes of Italian kiwifruit had been passed off as the superior French kind.

Companies that fake their own wares are unusual. More commonly, raw materials get accidentally mixed up as they make their way through supply chains, or dubious third parties pass off low-grade goods as high-quality products. Oritain’s first-ever client, a New Zealand firm called Silver Fern Farms, had just this problem.

Silver Fern sources beef from farms that rear grass-fed cows in New Zealand and then sells the meat at a premium price in supermarkets in other countries, including China. But Silver Fern doesn’t deal directly with these supermarkets, of course. In between Silver Fern’s headquarters in Dunedin and a Beijing supermarket lie numerous intermediaries: firms that import packaged Silver Fern beef into China, for instance, or that distribute the beef to supermarkets in a particular region. This is, quite sensibly, the framework for most modern business – each task handled by a company that does just that and does it well.

But this multiplicity of actors also leaves room for swindlers. In China, someone was wrapping up cuts of cheap local beef in fake Silver Fern packaging and selling them to supermarkets for a plump profit. Perhaps they were importers working with Silver Fern or posing as distributors claiming to have stocks of Silver Fern beef. But the end result was the same: shoppers paying more for meat they thought was scrupulously sourced but wasn’t.

Oritain’s assignment was to conduct random checks on “Silver Fern” packaged beef bought from Chinese supermarkets, testing the meat to see if it truly originated in Silver Fern’s farms, trying to narrow down how the fakes were turning up. Silver Fern knew the hazards of letting this fraud go on unchecked. In a culture that has chosen to care, even obsess, about authenticity, phoney products can tip a company into an irreversible fall.

In its earliest days, element analysis wasn’t often used to settle questions of origin. Instead, archaeologists measured elements to piece together the diets of long-dead humans in ancient graves, and the EU’s wine databank, set up in 1991, assayed the element ratios in wine to see if it had been “sugared” or watered down. Only around the turn of the 21st century did scientists start employing these tools to discover where materials came from. The real breakthrough came in a case involving not cocoa fraud or mislaid cotton, but the unsolved murder of a little boy.

In 2001, a pedestrian on Tower Bridge spotted a body in the Thames, although in the tricky light of a September evening, he mistook it for a barrel. Then he recognised his error and rang the police. Twenty minutes later, a patrol boat arrived to scoop the body out of the water. Someone had cut the head and limbs off the boy, and the torso wore only a pair of fluorescent orange shorts. When Will O’Reilly, a detective inspector with the Metropolitan police, was called in, he recalled other bodies from the Thames that he’d seen, several mangled by boat propellers. But after he saw the torso, he realised this was something he’d never encountered before.

Postmortems supplied one gruesome mystery after another. The child, between five and seven years old, had no blood remaining in his body. His stomach was empty, as if he’d been starved for days. The body was cut up in such precise, unusual ways that the surmise of a ritual sacrifice emerged in the very first postmortem. But none of this solved the essential question of who the boy was and where he’d come from. O’Reilly had no fingerprints or dental records to examine. Running the boy’s DNA through a database showed no relatives in the UK. Gene sequences suggested that he was of northern or western African descent, but they couldn’t spell out when he had last been in that part of the world, or if he’d ever been there at all. He was so profoundly, tragically anonymous that the police investigators called him Adam, to accord him the dignity of a name.

Half a century ago, the case would have stalled there, but in early 2002, a geology professor gave the police an idea. If the elements in the soil and water of a region work their way into the plants grown there, they also work their way into our bodies when we eat the produce of those plants, or when we eat the meat of animals fed on those plants. We ingest these elements, process them, and use them to build flesh, teeth and bones. So the elements making up our bodies can tell us something about the food we’ve eaten and the land that supports us. All of us are composites of what we consume, the geologist said. Perhaps this science might reveal where Adam was from?

In Adam’s bones, the concentrations of the elements strontium and neodymium suggested that he had spent most of his life in west Africa – possibly in Nigeria, or parts of Benin or Cameroon. To refine their search, O’Reilly and two colleagues travelled through Nigeria to take samples, covering 17,000 miles in three weeks. “We’d go out to the middle of farmers’ fields and collect soils and rock,” O’Reilly told me. “We got bone samples from mortuaries. We bought bush meat being sold by the side of the road.” Of the 150 or so samples they brought back, the nearest match to Adam’s strontium-neodymium levels came from human remains from a mortuary in Benin City, in southern Nigeria. Adam had lived most of his brief life in this rough vicinity, geologists suggested. The local police began making inquiries, asking people if they knew a boy who’d travelled to England, or if they recognised his pair of bright orange shorts.

A Nigerian woman came forward claiming to have known the boy, but her story kept changing and there were serious doubts about her reliability. No definitive evidence of Adam’s real identity was ever found, and the case remains unsolved. But the element analysis that led O’Reilly to western Africa turned out to be a pioneering piece of forensic research – reviewed in scientific journals, written up in textbooks, discussed at conferences. Oritain traces its methods directly back to the “Torso in the Thames” investigation. “That was a landmark case,” Rupert Hodges, Oritain’s chief commercial officer, told me. “We adapted the forensic science that came out of that case, and out of similar cases like it.”

The life and death of Adam bore strange, sad resemblances to the corrupted supply chains that warrant Oritain’s attentions. Here was a boy who was transferred frictionlessly from one continent to another, as if reduced to a commodity – a boy whose blurred origins and unresolved end were reminders that, while our globalised world pretends to be small and transparent, it is in fact huge and murky, with plenty of room to hide.

When Welspun came to Oritain, in the wake of its scandal, it was already too late to detect precisely where the mistakes had been made. The inferior cotton had passed through Welspun’s factories, been made into bedsheets, sold, and been slept upon. What Welspun wanted was to reassure its retailers that such a debacle couldn’t happen again. “They basically said to us: ‘How do we get back into the good graces of these big-box stores?’” Hodges told me.

Hodges is a bespectacled Englishman, a former banker who talks torrentially fast; more than once, while listening to our recorded conversations, I checked to see if I was accidentally playing them at 2x. Hodges joined Oritain in 2014, going from managing 1,000 people to running a London office of one. When Welspun ran into trouble two years later, Oritain was hired to conduct regular audits on the company’s supply chain.

To do that, though, Oritain needed to know the elemental signatures of Welspun’s cotton. So Oritain’s staff began by travelling to Egypt, fanning out across all the farms that supplied Welspun, picking “master samples” of cotton, and placing them into clear plastic bags. Then they did the same in the US, Australia, and every other country from which Welspun sourced cotton. The entire effort took six months, Hodges said, and resulted in tens of thousands of master samples.

Using these for comparison, Oritain could authenticate Welspun’s bales, yarn and fabric to make certain that no one was swapping in one kind of cotton for another. Shuttling between the various, far-flung tiers of suppliers, shippers, traders and factories, Oritain sampled and tested and sampled and tested, to ensure that every bit of cotton showed the elemental signatures of its origin – that cotton claiming to be from an Egyptian farm really was from that Egyptian farm. It was a way to make the supply chain more watertight, more reliable. In May 2021, Target agreed to start stocking Welspun products again.

Oritain has an ever-expanding library of master samples – verified specimens of beef, apples, cotton, wool and other commodities taken from their source farms, orchards or abattoirs. Hundreds of thousands of such samples rest in clear plastic bags in a warehouse in the basement of Oritain’s office building in Dunedin, in southern New Zealand. One part of the basement is a walk-in freezer for holding perishables. There’s a second warehouse, by way of backup, in case the Dunedin building is flooded or burns down. Oritain refused to tell me where that warehouse is.

Ordinarily, Oritain’s employees try to collect new master samples themselves; in places they can’t easily access they rely on local non-profits or other organisations. In its warehouse, Oritain has preserved samples from more than 150 countries: Patagonian toothfish meat from oceans near the Antarctic, cashmere from Inner Mongolia, quinoa from farms 3,500m up in the Bolivian Andes. Then, to run supply-chain audits or check for counterfeits, Oritain hires squads of inspectors from certification agencies such as Bureau Veritas. Oritain itself has a staff of just 50; it would be hardly enough to keep constant watch on one big company’s supply chain, let alone several.

One day, I went to Cardiff to meet Stew Whitehead, a sales executive at Oritain. Whitehead had just moved to the UK from Oritain’s Geneva office, but like practically everyone else I spoke to at the company, he had grown up on a farm in New Zealand. That day, Whitehead planned to hit up supermarkets and buy lamb and beef packs emblazoned with the red-dragon logo of Meat Promotion Wales. This industry body, a group of Welsh farmers and meat processors, is an Oritain client. As with Silver Fern Farms, Whitehead’s sweep was intended to discover if any meat advertising itself as premium Welsh lamb or beef was in fact low-grade meat from somewhere else.

The utter strangeness of Whitehead’s operation made it quietly thrilling. We drove in his car to four supermarkets, which I’m not allowed to name, although a reasonable guess at the biggest chains in the country won’t be far off target. In every store, Whitehead headed straight for the meat aisle. If he found any lamb or beef with Meat Promotion Wales’ logo, he’d first take a photo of a package on its shelf – surreptitiously, because he has learned with experience that, for some reason, staff don’t always take kindly to this. (Once, in a shop in Germany, a store manager yelled at him. Since Whitehead doesn’t know the language, he couldn’t understand what the objection seemed to be.) Then he’d pay for the item – rump steak, 21 days matured, a pair of lamb chops or a rack of lamb – and take another photo of it in front of the store, before writing down its details on a log sheet and slipping it into a makeshift cooler on the back seat of his car. The skulking photography aside, I might have been tagging along with a very tall man as he shopped for his very hefty supper.

Whenever anyone collects a sample for Oritain, anywhere in the world, they’ll courier it to Dunedin. In the lab there, scientists will prep the sample – cut off a couple of square inches of beef, say, and slice away the outer layers with a stainless-steel knife to remove any contaminants from the butchering process. In a plasma spectroscope, which resembles a large, complicated photocopier, the sample gets tested for more than 45 chemical elements.

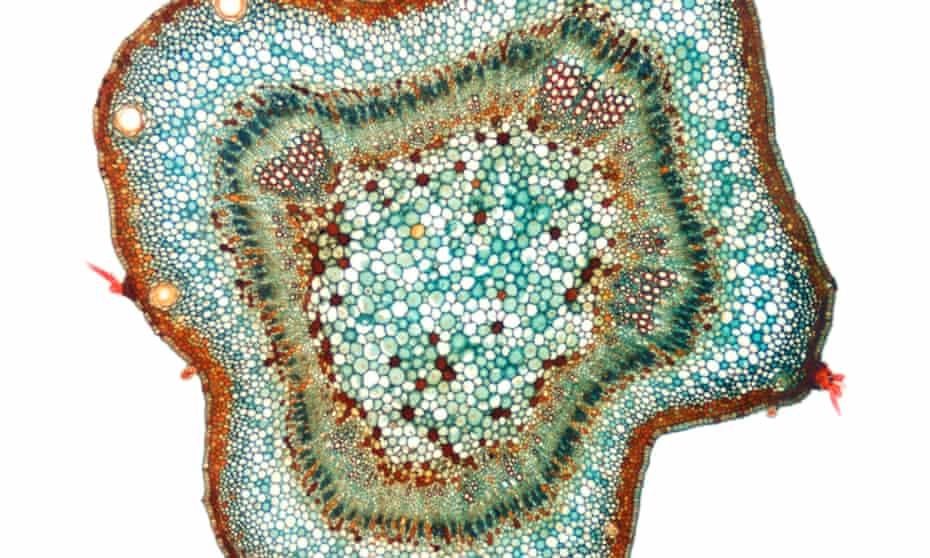

Of these, six are known as stable isotopes – variants of common elements that can be found in nature. Hydrogen, for instance, has a stable isotope named deuterium. It is slightly heavier and much more scarce than the most common kind of hydrogen we know – the kind that once filled zeppelins – but chemically they behave in very similar ways. Like hydrogen, deuterium bonds with oxygen to form water, and for roughly every 6,400 atoms of common hydrogen in seawater, there’s one of deuterium.

That’s an average, though. The ratio of deuterium to hydrogen in water changes from place to place, sometimes so distinctively that it becomes a marker of a particular location, said Simon Kelly, a food safety specialist at the International Atomic Energy Agency. “The ratio changes when water evaporates, when it condenses into clouds, when it pours down as rain and seeps into the earth. It changes depending on how far you are from the equator, or how high up you are, or as you travel inland from the coast.”

The stable isotopes of the other elements of life – carbon, oxygen, nitrogen and sulphur – are distributed unequally as well. So are other elements, in trace quantities – elements like strontium or rubidium or lead, which vary according to the rock and soil profiles of a location. One scientist sent me a British Geological Survey chart that mapped Britain for strontium. Spots where it was speckled a bright blue, showing higher concentrations of strontium in the ground, neatly mapped on to the igneous-rock terrain of the Lake District, north Wales, and the Scottish Highlands. Any animal that eats the produce of a place over the span of a few years will show the local signature of strontium in their bones. Dozens of other trace elements nest similarly in our bodies. Life is a periodic table made into flesh.

After Oritain receives its samples, its scientists need around two weeks to get their results – longer for cotton sometimes, if it has been mixed with a synthetic material like polyester, which first has to be stripped away. When I checked in with Whitehead a couple of weeks later, he hadn’t yet learned if the meat we’d bought was legit or not. Another, earlier recce had yielded no counterfeit meat, Whitehead said, but it never did to be complacent. “I’ve grown quite cynical in my time at Oritain,” he said. “I’ve seen so much fraud that I don’t trust anything I read on labels any more.”

Behind Whitehead’s disillusionment – behind the very existence of a company like Oritain – lies the story of modern commerce. Two clashing trends stand out. The first is, to consumers like us, more obvious: the importance accorded to the origin of a product. Shoppers have paid attention to sourcing, off and on, since at least the 80s, but the 21st century has supplied a fresh burst of conscientiousness and a forest of standards and terms by which to judge products. These terms convey notions of quality – “organic”, “grass-fed”, “pesticide-free” – but they’re also signals of ethical practices like the fair use of labour. Companies eagerly advertise their diligence in their sourcing – not least because it gives them cachet and allows them to price their products higher.

At the same time, companies have never been further from the origins of their products. This second trend – essentially the evolution of the modern supply chain – has been under way for more than half a century, says Puvan Selvanathan, a trade and sustainability expert who spent years working in the UN. In the mid-20th century, he explained, a giant company like Unilever would be vertically integrated: “It would own farms, and processing factories, and maybe even shops to sell its products in.” Controlling as many stages of the process as possible was the cheapest, most reliable way to turn your raw materials into products.

But the apparatus of trade improved with time: transport links became frequent and secure, and middlemen and contractors sprouted to buy crops from farms or bale up raw cotton or take over other steps in supply chains. “It became cheaper to outsource,” Selvanathan said. Over the past 30 years, companies have shed many of their vestigial functions, until they became, Selvanathan said, “essentially just branding businesses”.

These new supply chains include so many parties, scattered over so much of the planet, that oversight can feel like a nebulous dream. Most supply chains feature so many manufacturers, traders, aggregators, agents and middlemen that the big brands actually selling the products know about just the one or two tiers nearest to them. Expecting them to know more “would be like asking: ‘How much do you know about your third cousin?’”, a supply chain veteran told me. “Not much. Why would you, if there’s been no need to talk to them at all?” That ignorance has even proved useful, enabling companies to deny any awareness of the furthest, messiest reaches of their supply chains, where labour laws slip and quality standards slide.

No industry better illustrates this than cotton. Its provenance matters tremendously – the august, long-fibred cotton from the black, wet soils of Egypt so different from the coarser, short-fibred kind from the Indian state of Gujarat. At the same time, processing cotton is an elaborate affair, requiring so many steps in so many different locations that the cotton’s origin can easily get obscured.

When harvested cotton is taken to be cleaned and compacted – usually with a large mechanical “gin”, or engine – cotton from different farms might be packed into the same bale. In the US or Australia, bales are tagged with their area of origin, but the tags vanish during what the industry calls “the laydown”. “When they turn bales into yarn,” said Rupert Hodges, “they’ll lay typically 40 bales on the floor, in a line, and they have a machine that moves like that” – he sliced the air horizontally with his hand – “to cut the top off every bale. All that is then turned into a thick yarn, and you produce thinner yarn from that.” If bales from all over the world go into a laydown in a yarn factory, their cotton gets mixed further.

If the laydown hasn’t anonymised the cotton, the subsequent stages often will: fabric mills combining yarn from different spinning factories, cut-and-sew shops merging fabric from different mills, blend after blend all the way up. Often, clothing brands know only the identities of the mills that feed them fabric. “The brand might ask the mill: ‘Mate, are you sure you’re buying Egyptian cotton yarn?’” Hodges said. “And the mill says: ‘Yes, yes, we have an affidavit from the yarn spinner.’” Welspun had been using exactly these kinds of transaction certificates: pieces of paper issued and updated every time a bit of cotton went through some kind of processing. Clearly, though, the certificates were too easy to forge or manipulate. “It isn’t worth the paper it’s written on,” Hodges said. “Some spinners don’t care. And it’s too hard to find out all the places they buy their cotton from.”

As a consequence, the cotton industry is primed for two categories of shock. The first involves cotton discovered to be of poorer quality than advertised, as happened with Welspun – a result perhaps of an uncaring or double-crossing supplier, or of mix-ups in the supply chain. The second kind of shock involves sudden revelations about the people who grow or process the cotton – the conditions they work in, or the ways in which their rights are mangled – problems that far outweigh the discomfort of sleeping on sheets made of less-than-superfine cotton. Most recently, the apparel world has been roiled by revelations that cotton from Xinjiang, in China, is being grown and processed using forced labour. The scandal implicated some of the world’s biggest brands, including H&M, Nike, Adidas and Gap, and prompted sanctions and restrictions in the west on imports made of Xinjiang cotton. Last August, not long after the US banned all imports containing Xinjiang cotton, US customs authorities asked Oritain for a pilot demonstration of its cotton-tracing abilities.

Whether the companies sourcing cotton from Xinjiang were aware of what was happening on the ground before it became public is an open question. Most of the people I spoke to insisted that they couldn’t have known – that these brands are ignorant of everything except their nearest tier of suppliers. But they also never bothered to find out, said Laura Murphy, a professor of human rights at Sheffield Hallam University: “What they needed to say is: ‘If I can’t see where you’re getting the cotton from, I don’t want to do business with you.’” When some brands, such as H&M, Muji and Zara, expressed alarm over the revelations, the Chinese government encouraged crippling boycotts of their products. Within days, Zara pulled its critical statement off its website; Muji announced it had found no problems in Xinjiang.

At American ports, customs authorities now inspect imports thoroughly, looking for any products made of cotton that might have come from Xinjiang. Any suspected shipment is withheld by customs, said Andre Raghu, the CEO of HAP, a Boston-based consultancy that advises businesses on their supply chains; the company importing the products then has three months to provide sheaves of documents that prove the cotton’s origins. If the documents don’t conclusively prove that the goods were manufactured without the use of forced labour, the government impounds the shipment altogether.

Such seizures used to be rare. In all of 2017, Raghu said, it happened only once, but between October 2020 and June 2021, the US detained nearly 700 shipments on forced-labour suspicions. The prospect of having millions of dollars’ worth of products vanish into the wind in this manner, with no compensation in return, has scared companies stiff. Oritain has signed on 30 fashion clients in the last year alone, Hodges said, and “without question, they’ve come on board because of this”.

Globalisation, we were once told, would render every place in the world identical. Oritain’s work reveals that the opposite is true. Every place is distinct – not just in its histories or politics, but in its elemental materiality. The hydrogen, nitrogen, strontium and carbon in a region can furnish such unique produce that firms and states will go to any lengths to exploit it. They will force children or detainees into labour, pump chemicals into the soil or the animals living on it, lie about provenance, devise counterfeits – the kinds of rot in supply chains that Oritain wants to help sniff out.

Even Oritain’s limitations are telling. It can reveal where problems lie, but repairing them still requires companies and governments to act – the same companies and governments, in many cases, that introduced the rot into supply chains, or disregarded it, or chose not to know about it.

“The question I keep coming back to with tech fixes is: ‘So what?’” Puvan Selvanathan said, referring to the kinds of solutions offered by Oritain, but also by other firms that promise transparency via DNA markers or blockchain. “Say you can track the supply chain between Brazil and the Netherlands with element tracing or blockchain or whatever. So what? Does that prevent a worker from being paid an unfair wage, or the product from being grown in a stripped 100,000 hectares in the Amazon rainforest? The answer is no.” Even the failed investigation into the murder of Adam, the boy in the Thames, taught the same lesson. Element analysis is, in the end, just data: it can only ever be an ingenious aid to devising a fix, and not the fix itself.

Hodges told me the story of an expensive chocolate brand that projects itself to be the soul of sustainability. The brand doesn’t process its own cocoa; instead, it buys chocolate from one of several chocolate giants that are defending themselves in a child labour lawsuit in the US. Last year, Oritain’s executives got in touch with the expensive chocolate brand, Hodges said, and pitched their services.

“They told us: ‘Look, we’ve got a lot of other things on at the moment.’ They were spending all their money on marketing,” Hodges recalled. “Then we told them: ‘You don’t have to pay. We’ll do it for you for free.’ We wanted to do it as a proof of concept.” The brand refused even this offer, he said. “Maybe they knew they had problems somewhere, but didn’t know what problems they were, and didn’t want them to be identified.”

Hodges shrugged in mock-despair, as if to say that Oritain couldn’t help those who didn’t want to help themselves. Or that this was the state of the world: companies knowing that their closets are untidy and likely full of skeletons, but keeping the door tightly shut nonetheless, in the hope that nothing will ever tumble out.

[ comments ]