Comments by Brian Shilhavy

Editor, Health Impact News

The Wall Street Journal sent shock waves through the financial world Saturday night when they reported that the FDIC seized nearly $14 billion in foreign deposits at Silicon Valley Bank in the Cayman Islands last March, mostly from Chinese investment firms, which had been waiting to gain access to their funds.

It’s not happening.

Two months after the failure of Silicon Valley Bank, the lender’s depositors in the Cayman Islands have been left out in the cold.

The California-based bank’s American depositors were protected when the Federal Deposit Insurance Corp. took control of SVB on March 10 and guaranteed all of their funds. SVB’s U.S. branches, as well as its loans and deposits, were acquired by First Citizens Bancshares in late March.

It has been a vastly different story for customers of SVB’s Cayman Islands branch, which was left out of the First Citizens deal and placed under FDIC receivership. The branch in the offshore tax haven was set up to primarily support the bank’s activities in Asia, according to SVB. Its depositors, which include multiple Chinese investment firms, haven’t been able to access their funds—and have been in limbo since SVB’s collapse.

The FDIC’s notice surprised customers who had thought an earlier statement from U.S. regulators that said all SVB depositors would be made whole also applied to them. (Source.)

As Pam Martens reported this morning, this will most certainly cause a bank run on all unsecured foreign deposits, which is over $1 trillion in just two banks: JPMorgan Chase and Citigroup’s Citibank.

[T]here were gasps of shock on Saturday evening at around 5:30 p.m. when the Wall Street Journal published the stunning news that depositors in the Cayman Islands’ branch of Silicon Valley Bank had their deposits seized by the Federal Deposit Insurance Corporation (FDIC), which they are unlikely to ever see again.

As Wall Street On Parade has previously reported, under statute, the FDIC cannot insure deposits held on foreign soil by U.S. banks.

Adding to what is certain to be political fallout, the depositors left out in the cold in the Cayman Islands branch included “investment firms in China and other parts of Asia.” Those depositors can’t be too happy to see their deposits seized while everyone else gets protected, whether they had deposit insurance or not.

What the Wall Street Journal has actually done with this report is to open a Pandora’s box regarding the vast sums of foreign deposits held in foreign branches of JPMorgan Chase and Citigroup’s Citibank – none of which are covered by FDIC insurance. It further raises the question as to why the banking regulators of these two Wall Street mega banks have allowed this dangerous situation to occur.

According to the year-end call report filed by Citibank, it held a stunning $622.6 billion of deposits in foreign offices. (See page 34 of call report.) According to the year-end call report filed by JPMorgan Chase Bank N.A., it held $426 billion in deposits in foreign offices. (See page 34 of the linked report.) Together, these two banks held just over $1 trillion in deposits on foreign soil – which had no U.S. deposit insurance backing. (Source.)

As Mike Shedlock of MishTalk.com reported, the FDIC has now sent a clear message to foreign depositors: You can’t trust U.S. Banks.

The clear message by the FDIC is don’t bank in the US. If you do, it better be at a one of the giant too big to fail banks.

If you are a foreign depositor at any small or midsized bank, the FDIC is affirming that you better get your money out now.

Let the foreign deposit run begin. (Source.)

If this news wasn’t bad enough, we also have the alleged political posturing going on right now over whether or not Congress is going to raise the U.S. debt limit, or default on some government obligations, like U.S. Treasuries.

Asia (Japan and China) holds a vast majority of foreign held U.S. Treasuries (source), and probably a lot of the same investment firms that just lost all their deposits at Silicon Valley Bank.

This past Friday, U.S. Treasury Secretary Janet Yellen stated that the U.S. has “to default on something” if a new debt ceiling is not reached by Congress, and that includes U.S. Treasuries.

“If Congress fails to do that, it really impairs our credit rating. We have to default on some obligation, whether it’s Treasuries or payments to Social Security recipients,” Yellen said Friday in an interview with Bloomberg Television. “That’s something America hasn’t done since 1789. And we shouldn’t start now. So we’ve not discussed what to do.” (Source.)

Economists are almost unanimously stating that the standoff in Congress is all show, and that there is no possible way that the U.S. Government would allow a default on its debt.

Orman thinks the consequences are too severe for U.S. congresspeople to follow through on threats to let the U.S. default on its debt. Everyone from foreign governments (which hold trillions in U.S. Treasuries) to insurers would be affected.

Suze Orman spoke to Sheila Blair, former chair of the Federal Deposit Insurance Corporation (FDIC), who shares Orman’s opinion. They believe that despite the drama in Congress right now, the chance of the U.S. government defaulting on its debt is tiny. (Source.)

But should we trust the corporate media? You know, the same ones who said our Government would not intentionally lock everyone down during COVID-19 if the threat was not real, and that the experimental COVID shots were totally safe and effective?

The fact is that U.S. politicians do not run the United States. The corporate billionaires and bankers do, and they have systematically worked against the people by enriching their accounts with $trillions that Donald Trump gave them for COVID in 2020 while driving many small businesses to bankruptcy, while at the same time killing and maiming millions of Americans with Trump’s clot shots.

And here in 2023, Biden’s FDIC just wiped out $14 billion in foreign deposits at Silicon Valley Bank.

So why wouldn’t these same people in control of Wall Street and the U.S. banking system not collapse the economy by defaulting on their debt, and then allow Republican and Democratic lawmakers in D.C. take the blame?

Isn’t that the whole purpose of the Great Reset from the Davos crowd?

In fact, it is possible that some politicians have already received the memo, as some of them have already stated that it will take “a stock market collapse” to break the current stalemate in Congress over raising the debit ceiling, perhaps preparing the public for just such an event.

A key Democrat is warning this week that only a stock market collapse will break the partisan stalemate over raising the debt ceiling and preventing a government default over the summer.

Rep. Jim Himes (D-Conn.), a former Goldman Sachs executive and senior member of the Financial Services Committee, said the Republicans’ opposition to a debt limit hike without steep spending cuts is so entrenched that only an economy-rattling market tumble — like the crash that accompanied the financial crisis of 2008 — will shake GOP leaders to accept a bipartisan compromise. (Source.)

The U.S. bond market is the foundation for the global financial system, with the dollar as the reserve currency and Treasury debt long regarded as the world’s safest and most liquid financial asset — a status Yellen said would be eroded in a default.

Yellen delayed her trip to Japan to personally call U.S. business executives and appear on several major television shows to warn U.S. lawmakers that failure to raise the $31.4 trillion borrowing cap would be a “catastrophe” for global financial markets and the economy. (Source.)

Even if this is all just posturing and the debt ceiling is either eliminated or extended, the Wall Street Journal’s article this weekend will most assuredly increase the departure of foreign funds on deposit in America’s banks, now that they have learned that everything they had on deposit in Silicon Valley Bank is gone.

See Also:

Understand the Times We are Currently Living Through

The God of All Comfort

Who are the Children of Abraham?

God Will Not be Made a Fool – A Person Reaps What he Sows

An Invitation to the Technologists to Join the Winning Side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

How to Determine if you are a Disciple of Jesus Christ or Not

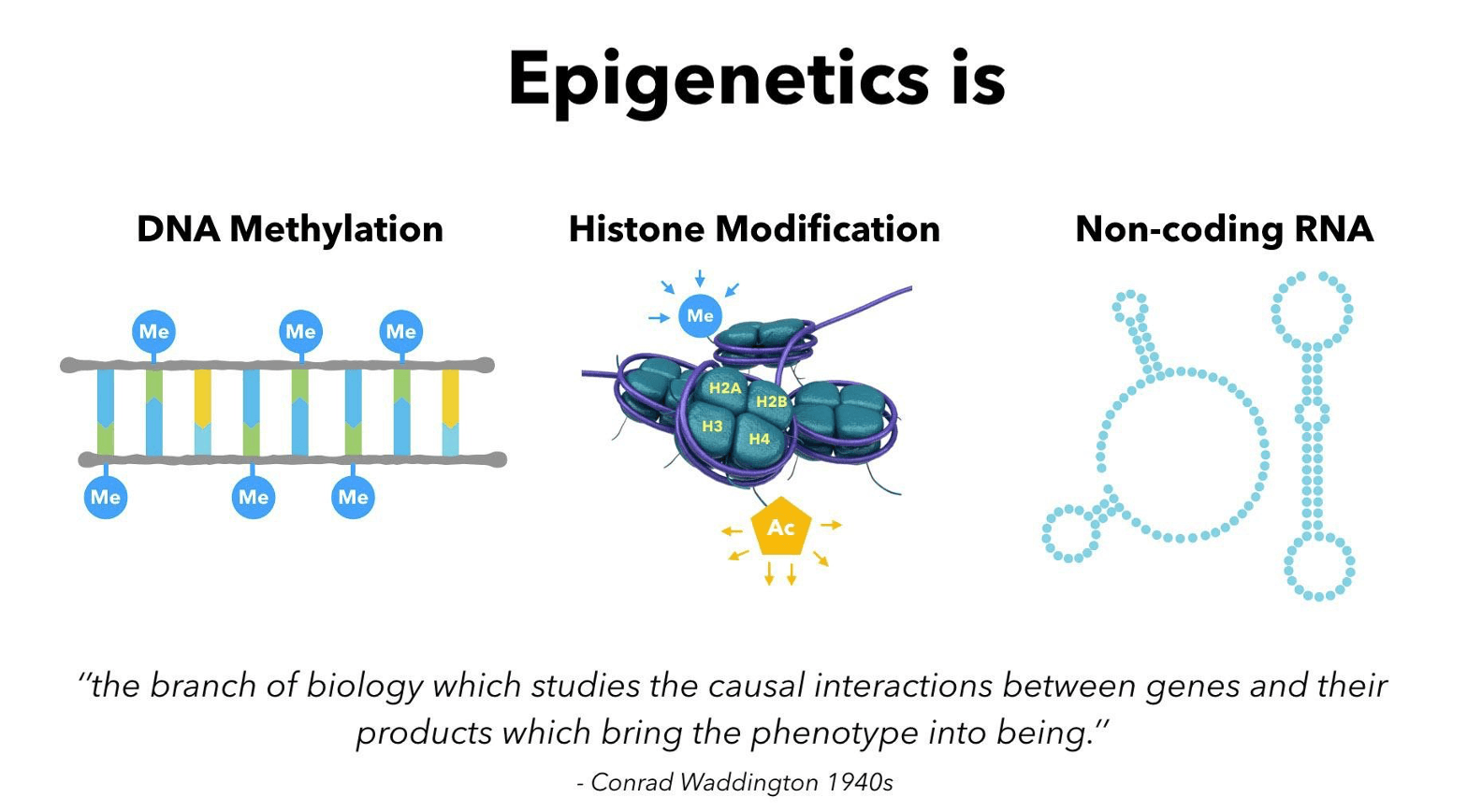

Epigenetics Exposes Darwinian Biology as a Religion – Your DNA Does NOT Determine Your Health!

What Happens When a Holy and Righteous God Gets Angry? Lessons from History and the Prophet Jeremiah

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 7-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

The post $14 Billion in Foreign Deposits at Silicon Valley Bank were NOT Bailed Out – More than $1 Trillion Foreign Deposits at Chase and Citibank as U.S. Debt Crisis Looms first appeared on Health Impact News.